Preservation of Affordable Housing

Business Overview

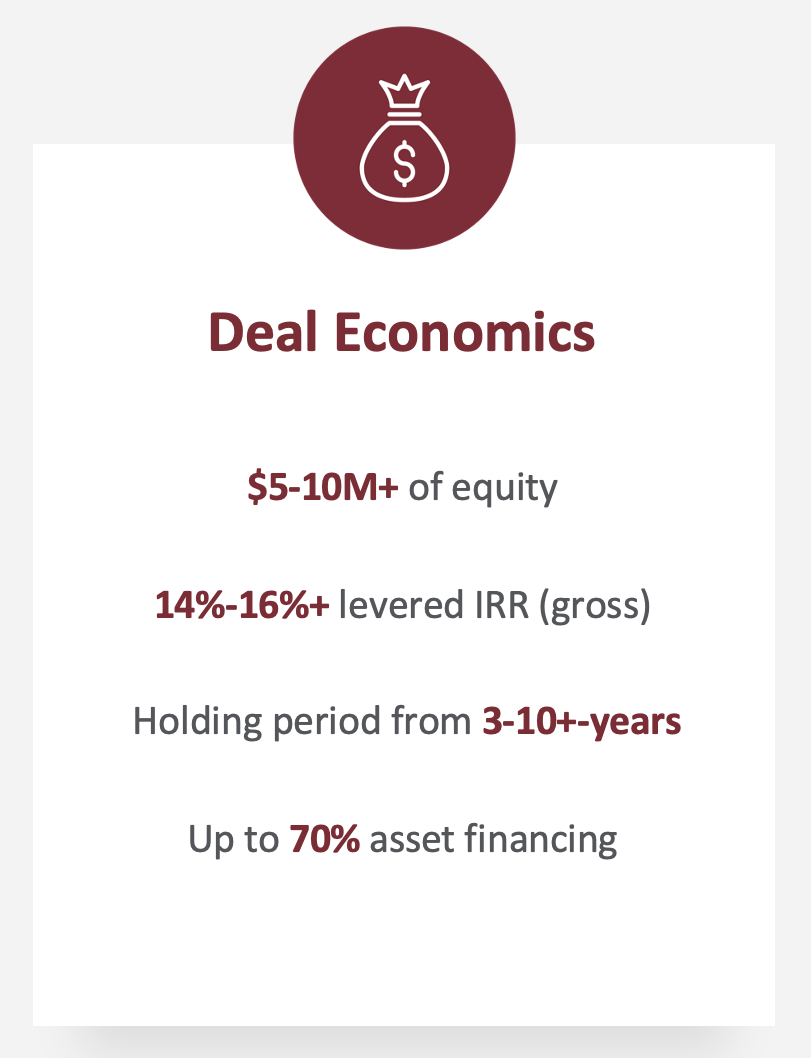

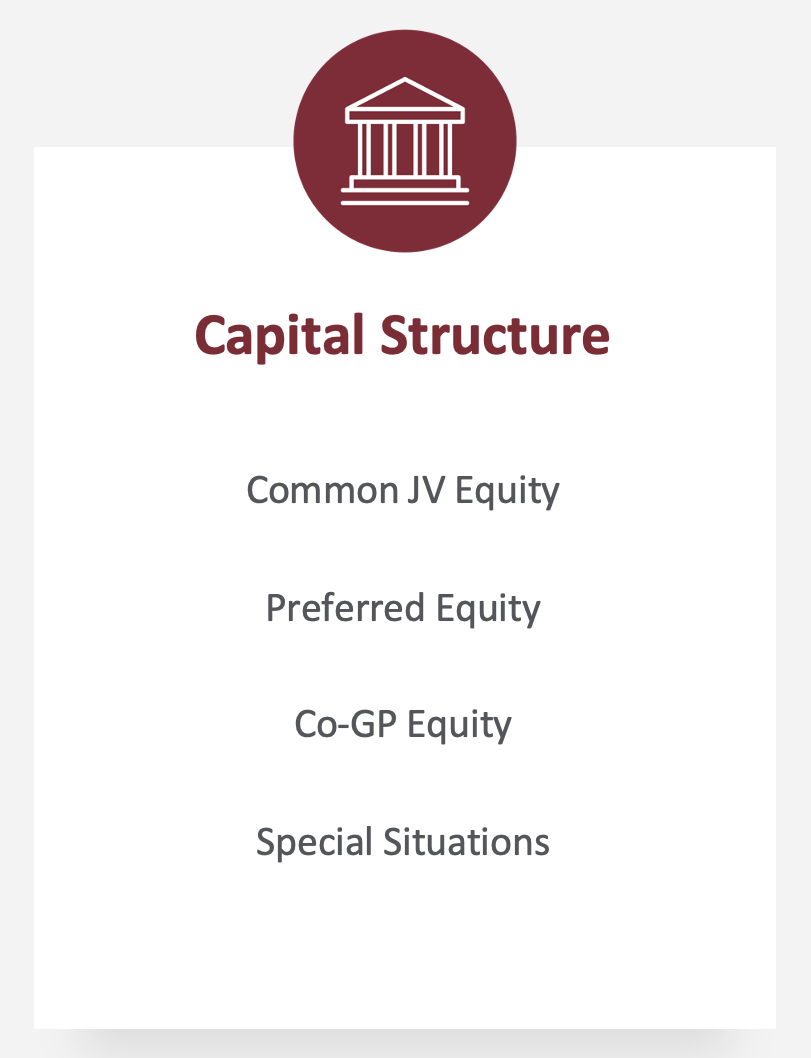

Red Stone Equity Partners realizes that low income housing tax credits cannot be the sole solution to the ever-growing lack of affordable housing throughout the United States. Red Stone’s preservation efforts build on our 17-year proven track record of investing in and managing more than $11 billion of tax credit equity. Our platform seeks to invest alongside best-in-class operators in select high-growth markets in the United States that have a strong demand for affordable housing as a result of demographic and market trends. We underwrite and structure our investments to preserve capital, produce consistent cash yields and generate attractive risk-adjusted returns for our investors.

For further information, please contact Brian Fishback at brian.fishback@rsequity.com.